The Value of Mortgage Broking

While rightly calling out the poor behavior of some individuals, there has been little focus on the much greater benefit the mortgage broking industry brings to a large group of Australians who otherwise do not have access to free, impartial advice.

Mortgage brokers are now central to the Australian financial services landscape. In fact, the majority of Australians now choose to use a mortgage broker for, what will be for many, the most important financial decision of their lives.

Mortgage brokers offer access to many lenders; the ability to deliver multiple product options to meet many customers’ needs and provide ongoing service and support.

While the further transparency provided by a royal commission is welcomed by the industry, what is missing from the debate has been a clear understanding of the function the industry plays in the Australian property market and the value of the services that mortgage brokers provide to customers, lenders and the broader economy.

With this is mind the Mortgage Broking Industry Group (MBIG), an industry working group intent on better informing the public debate, was formed in 2017.

The MBIG engaged Deloitte Access Economics to produce a report that provides up to date information about the industry and its role in the economy. This report is now available to share with politicians, regulators and other influencers and decision-makers. Its key points are summarised below and in a fact sheet that you can download here.

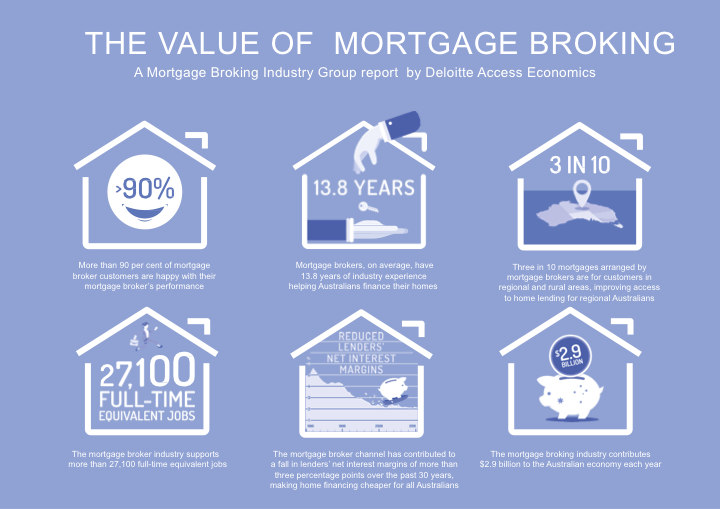

The report, “The Value of Mortgage Broking”, clarifies the industry’s function and value using publicly available information and the quantitative evidence. The report clearly shows:

- The value provided to consumers through better customer service, increased choice and lower search costs.

- The positive impact the mortgage broking industry has on the Australian economy though enhanced competition in financial markets, lower interest rates and reduced costs to borrowers.

- The important role mortgage brokers play in providing smaller lenders with an effective distribution network that can reach interstate, regional and rural consumers.

- The economic impact the industry has as a collection of small businesses that provides direct employment to over 27,000 Australians.

The next step is for us as an industry is to start to engage with influencers and decision-makers to share this information.

As an aggregation business I will reach out to regulators and other government bodies to share the report and answer any questions. I have also shared the report directly with the brokers that nMB serves and requested them to do likewise, starting with their local members of parliament.

I believe this report provides an important education tool about the function of our industry and its important role in the Australian economy. I would like it to be a catalyst for a more informed debate and an improved perception of the industry amongst decision-makers – hopefully to the very positive levels already enjoyed from the general public.

Gerald Foley

A full copy of the report can be downloaded here.